SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEADVISORY VOTE ON EXECUTIVE COMPENSATION

We are providing our stockholders the opportunity to vote to approve, on an advisory, non-binding basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules. This proposal, which is commonly referred to as “say-on-pay,” is required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or Dodd-Frank Act, which added Section 16(a)14A to the Exchange Act. Section 14A of the Exchange Act also requires that stockholders have the opportunity to cast an advisory vote with respect to whether future advisory votes on the compensation paid to our directors,named executive officers and persons who own more than ten percent of a registered classwill be held every one, two or three years. At the 2023 annual meeting, our stockholders approved, on an advisory, non-binding basis, an annual advisory vote on the compensation of our equity securities to file reports of ownership and changes in ownershipnamed executive officers. In accordance with the SEC. Such persons are required by SEC regulationsresults of this vote, our board of directors determined to furnish us with copiesimplement an advisory vote on the compensation of allour named executive officers every year until the next vote in 2029 on the preferred frequency of such filings. Based solely on our review of the copies of the reports that we receivedadvisory votes.

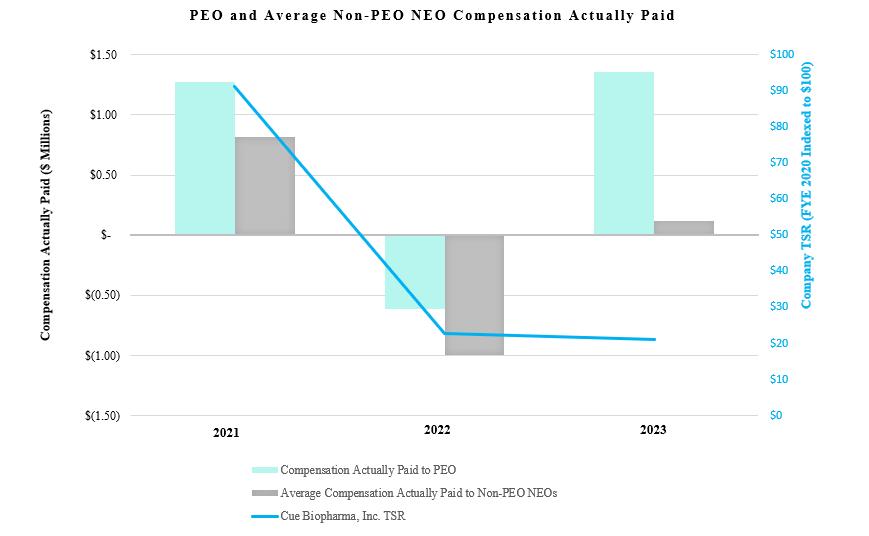

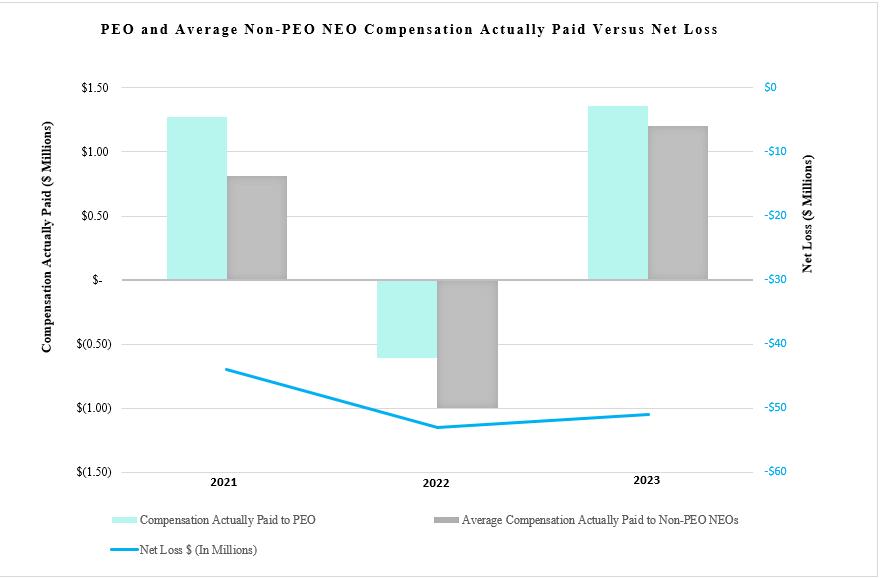

Our executive compensation program is designed to reward value creation for stockholders and written representations that no other reports were required, we believe thatto attract, motivate, and retain our executive officers, directors and greater than 10% stockholders complied with all applicable filing requirements on a timely basis during 2017, except that (i) each of directors andwho are critical to our success. Under this program, our named executive officers failed to file timely a Form 3 uponare rewarded for the effectiveness of the registrationachievement of our common stock under Section 12(b)short- and long-term strategic and financial goals, which we believe serves to enhance short- and long-term value creation for our stockholders. The program contains elements of cash and equity-based compensation and is designed to align the Exchange Act, (ii) Ken Pienta failedinterests of our executives with those of our stockholders and paying for performance.

The section of this proxy statement titled “Executive Compensation” beginning on page 22 including “Narrative to file timely one Form 4 with respect to common stock he purchasedSummary Compensation Table,” describes in detail our initial public offeringexecutive compensation program and (iii) Christopher Marlett, Cameron Graythe decisions made by our compensation committee and Gary Schuman each failed to file timely a Form 4our board of directors with respect to the assignmentfiscal year ended December 31, 2023. Our executive compensation program rewards value creation for stockholders and progress towards achieving our mission and that promotes company performance. At the same time, we believe our program does not encourage excessive risk-taking by MDBmanagement. While we do not have a formal or informal policy for allocating between long-term and short-term compensation, between cash and non-cash compensation or among different forms of warrants issuednon-cash compensation, we generally strive to underwritersprovide our named executive officers with a mix of short-term and long-term performance-based incentives to encourage consistently strong performance, and our board of directors believes that this link between compensation and the achievement of our short- and long-term business goals has helped drive our performance over time.

Our board of directors is asking stockholders to approve a non-binding advisory vote on the following resolution:

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and any related material disclosed in connectionthis proxy statement, is hereby approved.

As an advisory vote, this proposal is not binding. The outcome of this advisory vote does not overrule any decision by the company or the board of directors (or any committee thereof), create or imply any change to the fiduciary duties of the company or the board of directors (or any committee thereof), or create or imply any additional fiduciary duties for the company or the board of directors (or any committee thereof). However, our compensation committee and board of directors value the opinions expressed by our stockholders in their vote on this proposal and intend to consider carefully the outcome of the vote when making future compensation decisions for named executive officers.

OUR BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

STOCKHOLDER PROPOSALS FOR OUR 2025 ANNUAL MEETING

Stockholder Proposals Included in Proxy Statement

In order to be considered for inclusion in our proxy statement and proxy card relating to our 2025 annual meeting of stockholders, stockholder proposals must be received by us no later than December 27, 2024, which is 120 days prior to the first anniversary of the mailing date of this proxy, unless the date of the 2025 annual meeting of stockholders is changed by more than 30 days from the anniversary of the Annual Meeting, in which case, the deadline for such proposals will be a reasonable time before we begin to print and send our proxy materials. Upon receipt of any such proposal, we will determine whether or not to include such proposal in the proxy statement and proxy card in accordance with regulations governing the solicitation of proxies.

Stockholder Proposals Not Included in Proxy Statement

In addition, our initialbylaws establish an advance notice procedure for nominations for election to our board of directors and other matters that stockholders wish to present for action at an annual meeting other than those to be included in our proxy statement. In general, we must receive other proposals of stockholders (including director nominations) intended to be presented at the 2025 annual meeting of stockholders but not included in the proxy statement by March 7, 2025, but not before February 5, 2025, which is not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual meeting. However, if the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice must be received no earlier than the close of business 120 calendar days prior to such annual meeting, and no later than the later of the close of business on the later of 90 days prior to such annual meeting and 10 days following the day on which notice of the date of such annual meeting was mailed or public offering.announcement of the date of such annual meeting was first made. If the stockholder fails to give notice by these dates, then the persons named as proxies in the proxies solicited by the board of directors for the 2025 annual meeting of stockholders may exercise discretionary voting power regarding any such proposal. Stockholders are advised to review our bylaws which also specify requirements as to the form and content of a stockholder’s notice.

In addition to satisfying the advance notice provisions in our bylaws relating to director nominations, including the earlier notice deadlines set out above, to comply with the SEC’s universal proxy rule, stockholders who intend to solicit proxies in support of director nominees other than our nominees in compliance with Rule 14a-19 under the Exchange Act must also provide notice that sets forth the information required by Rule 14a-19 no later than April 7, 2025. If the date of the 2025 annual meeting of stockholders changes by more than 30 days from the anniversary of this year’s Annual Meeting, such notice must instead be provided by the later of 60 days prior to the date of the 2025 annual meeting of stockholders or the 10th day following public announcement by us of the date of the 2025 annual meeting of stockholders.

Stockholder proposals must be delivered to the Company’s Secretary at 40 Guest Street, Boston, Massachusetts 02135.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some brokers and other nominee record holders may be “householding” our proxy materials. This means a single notice and, if applicable, the proxy materials, will be delivered to multiple stockholders sharing an address unless contrary instructions have been received. We will promptly deliver a separate copy of the Notice and, if applicable, the proxy materials and our 2023 Annual Report, which consists of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, to you if you write us at Secretary, Cue Biopharma, Inc. 40 Guest Street, Boston, Massachusetts 02135 or call us at (617) 949-2680. If you would like to receive separate copies of our proxy materials and annual reports in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, brokerage firm or other nominee record holder, or you may contact us at the above address and telephone number.

OTHER BUSINESSMATTERS

The Board knowsWe do not know of noany business that will be presented for consideration or action by the stockholders at the Annual Meeting other than those items stated above.that described in this Proxy Statement. If, however, any other business is properly brought before the meeting, shares represented by proxies will be voted in accordance with the best judgment of the persons named in the proxies or their substitutes.

We hope that you will attend the Annual Meeting. Whether or not you plan to attend, we urge you to vote your shares over the Internet or by telephone, or to complete, date, sign and return the proxy card in the postage-prepaid envelope. A prompt response will greatly facilitate arrangements for the meeting, and your cooperation will be appreciated.

styleINA

Scan QR for

digital voting

P.O. BOX 8016, CARY, NC 27512-9903

Your vote

matters!

Cue Biopharma, Inc.

Annual Meeting of Stockholders

Wednesday, June 5, 2024 9:00 AM, Eastern Time

Annual Meeting to be held virtually via the internet - please visit www.proxydocs.com/CUE for

more details.

You must pre-register to attend the meeting online and/or participate at

www.proxydocs.com/CUE.

For a convenient way to view proxy materials, VOTE, and obtain

directions to attend the meeting, go to www.proxydocs.com/CUE

To vote your proxy while visiting this site, you will need the 12 digit

control number in the box below.

This communication presents only an overview of the more complete proxy materials that are

available to you on the Internet. This is not a ballot. You cannot use this notice to vote your

shares. We encourage you to access and review all of the important information contained in

the proxy materials before voting.

Under United States Securities and Exchange Commission rules, proxy materials do not have

to be delivered in paper, unless requested. Proxy materials can be distributed by making them

available on the internet.

If you want to receive a paper or e-mail copy of the proxy materials, you must request one.

There is no charge to you for requesting a copy. In order to receive paper materials in time for

this year's meeting, you must make this request on or before May 24, 2024.

Proxy Materials Available to View or Receive: Proxy

Statement, Proxy Card & Annual Report

Important Notice Regarding the Availability

of Proxy Materials for the Stockholders

Meeting To Be Held On June 5, 2024 For

Stockholders of Record on April 12, 2024

To order paper materials, use one of the

following methods.

Internet:

www.investorelections.com/CUE

Call:

1-866-648-8133

Email:

paper@investorelections.com

* If requesting material by e-mail, please send a blank e-mail with the

12 digit control number (located below) in the subject line. No other

requests, instructions OR other inquiries should be included with your

e-mail requesting material.

Your control number

Have the 12 digit control number located in the

box above available when you access the

website and follow the instructions.

SEE REVERSE FOR FULL AGENDA

Copyright © 2024 BetaNXT, Inc. or its affiliates. All Rights Reserved

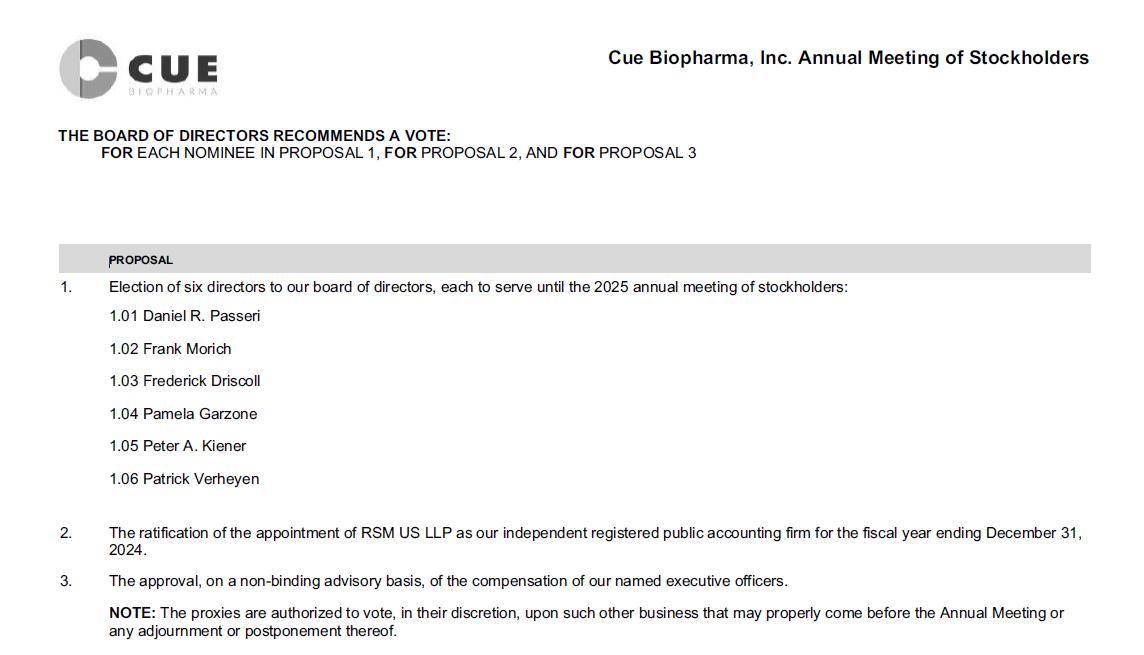

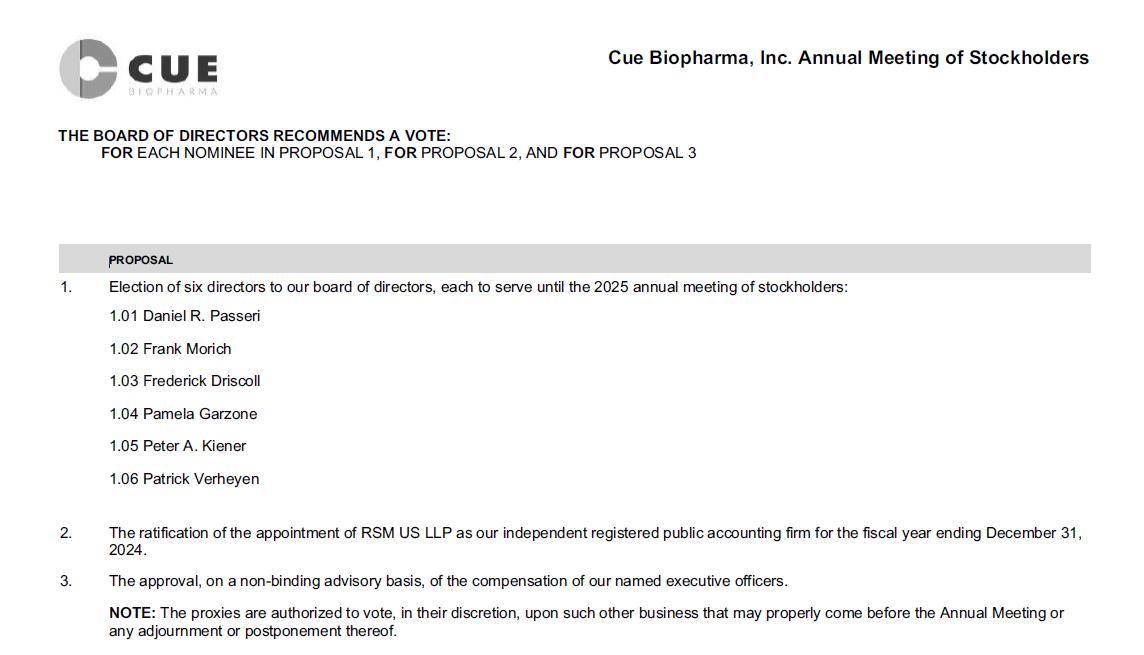

Cue Biopharma, Inc. Annual Meeting of Stockholders

THE BOARD OF DIRECTORS RECOMMENDS A VOTE:

FOR EACH NOMINEE IN PROPOSAL 1, FOR PROPOSAL 2, AND FOR PROPOSAL 3

PROPOSAL

1. Election of six directors to our board of directors, each to serve until the 2025 annual meeting of stockholders:

1.01 Daniel R. Passeri

1.02 Frank Morich

1.03 Frederick Driscoll

1.04 Pamela Garzone

1.05 Peter A. Kiener

1.06 Patrick Verheyen

2. The ratification of the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending December 31,

2024.

3. The approval, on a non-binding advisory basis, of the compensation of our named executive officers.

NOTE: The proxies are authorized to vote, in their discretion, upon such other business that may properly come before the Annual Meeting votes may be cast pursuant to proxies in respect to or

any such business in the best judgment of the personadjournment or persons acting under the proxies.postponement thereof.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 12, 2018

The proxy statement and annual report to stockholders are available atwww.proxypush.com/CUE.

A copy of the Company’s Annual Report for the fiscal year ended December 31, 2017 is available without charge upon written request to: Secretary, Cue Biopharma, Inc., P.O. Box 390509, Cambridge, Massachusetts 02139.

25

Please separate carefully at the perforation and return just this portion in the envelope provided.

Please separate carefully at the perforation and return just this portion in the envelope provided.